Further to our article on 7th August 2020, the Federal Government released this week the Legislative Instrument regarding the extension of JobKeeper for the period following 28 September 2020 (“JobKeeper 2.0”). The instrument aligns with the initial guidance from the ATO in recent weeks. Currently, there is no further guidance on the alternative turnover tests.

Refer to the new ATO factsheet. We have also provided a summary below with FAQ. We will update the below where additional information is released. If there is a question that has not been considered, please feel free to contact us.

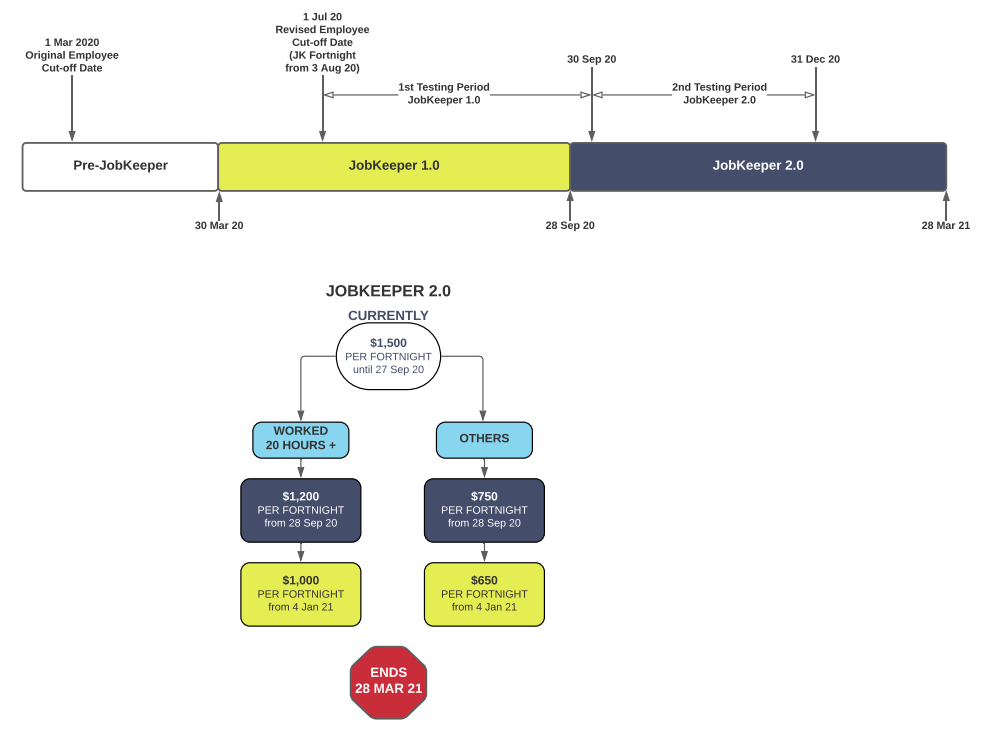

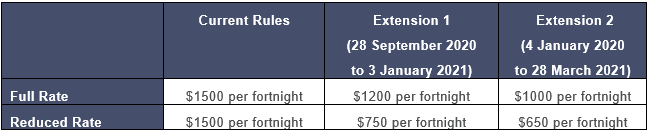

Time period and Rates for JobKeeper 2.0 (click for large version):

The two extension periods for JobKeeper 2.0 are:

How does an entity remain eligible for Extension 1 and Extension 2 (for standard situations where the Basic Test was satisfied for JobKeeper 1.0)?

Extension 1 – entities will need to satisfy an actual decline in GST-turnover for the quarter to 30 September 2020, compared to the corresponding period in 2019.

Extension 2 – entities will need to satisfy an actual decline in GST-turnover for the quarter to 31 December 2020, compared to the corresponding period in 2019.

The decline in turnover requirements remain the same as JobKeeper 1.0, as noted below:

• 50% decline for entities with an aggregated turnover of more than $1 billion;

• 30% decline for entities with aggregated turnover of $1 billion or less; and

• 15% decline for ACNC-registered charities.

How does this actual turnover test work when having utilised an Alternative Test to access JobKeeper 1.0?

There has been no guidance released on this yet.

Is JobKeeper 2.0 open to entities not already in JobKeeper 1.0?

Yes – JobKeeper remains open to new entities, provided that they meet both the original projected GST-turnover test and the new actual decline in GST-turnover test (referred to above).

Just a reminder that the assessment of eligibility should occur at the earliest possible opportunity in order to maximise the number of potential JobKeeper fortnights available.

Can an entity become eligible once again for Extension 2, having failed Extension 1?

Yes, provided all other relevant criteria are met.

What is the Employee Eligibility Requirements for the Full Rate?

An employee will be eligible for the Full Rate where their “hours worked” in the 28 days preceding 1 March 2020 OR 1 July 2020 exceeded 80 hours (i.e. an average of 20 hours per week). An employer must use the Full Rate for an employee if they meet the higher rate threshold in either period. Where the full rate eligibility is not met and the employee is eligible, then the reduced rate can be applied.

What is the guidance on “hours worked”?

Hours worked are actual hours worked, plus most forms of paid leave and paid public holidays. The Commissioner has been given the ability to give discretion to apply alternative test if an employee’s hours were not usual during the reference period (i.e. this may apply where an employee was on unpaid leave for bushfire purposes in February 2020 or on unpaid maternity leave in June 2020).

How does my monthly pay cycle tie into the 28 day assessment window?

The hours should be attributed on a pro rata basis across the monthly pay cycle.

What are the obligations of the business regarding these new rates?

The employer must notify the ATO which payment rate applies for each eligible employee in Extension 1 and 2. We understand that this will occur as part of the Single Touch Payroll.

The employer must also notify the employee of their relevant payment rate within 7 days of making this above notification to the ATO.

Do the Full & Reduced Rate requirements apply to Sole Trader and Eligible Business Participants?

JobKeeper eligibility continues for sole traders, a partner in a partnership, beneficiary of a trust, shareholder or director of company. The 20+ hour test also applies to sole traders and eligible business participants in extension 1 and 2. The 20+ hours test is calculated by reference to time spent actively engaged in the business.

Next Steps:

For businesses already in JobKeeper (and for those considering entering into JobKeeper 2.0), the following steps are recommended by the end of September 2020:

• Assessment of the actual quarterly GST-turnover for September 2020 (compared to September 2019); and

• Assessment of the hours worked by employees in the relevant reference period (being the 28 days preceding 1 March or 1 July 2020).

Further Legislative Instruments have clarified the following:

GST Turnover – What’s Different?

1. The entity does not use the projected turnover; the turnover test calculates the actual decline in turnover by comparing the relevant quarter (September 2020 for Jobkeeper Extension 1) against the quarter from the previous financial year (September 2019).

GST Turnover – Calculation

1. The entity must use the accounting basis they use for GST-reporting purposes. In summary, the GST turnover they calculate for their BAS (in most cases, being Total Sales (1) less GST on Sales (1A).

a. Exceptions may include:

i. Where a period includes GST adjustments relating to prior periods – provided these can be substantiated, this would not be included; or

ii. If the entity supplies goods or services, but the timing is not reflective of the BAS disclosures. We recommend reviewing the ATO’s alternative tests. As at the date of this publication, we are still awaiting the ATO to release the details.

Employee – Tier 1 or Tier 2

1. What if an employee who regularly works 80 hours in a 28 day period did not work for 80 hours in a 28 day period in either assessment period? Can the higher rate apply?

a. Yes – provided that the most recent true representation of their period passes the higher threshold test.

i. Eg: employee was on annual / sick / other leave during the period being tested (December 2019 – February 2020) – you are able to revert to November 2019 to confirm eligibility based on the representative assessment period.

2. What if an entity does not have comprehensive ‘hours worked’ records?

a. There are a number of concessions, only if the hours are not readily ascertainable:

i. An employee received more than $1,500 in the 28-day reference period (excluding JobKeeper ‘top-up’ amounts);

ii. Employee works on a contract or award which requires the employee to work at least 80 hours in a particular reference period; or

iii. Reasonable assumptions made about an employee. Example being that records are inaccessible due to natural disaster etc.

Alternate Tests

1. We note that the ATO have yet to release any details of the alternate tests. We will release an update as soon as these details are known.

Should you have any questions or require additional assistance to COVID-19 stimulus and upcoming changes, please do not hesitate to contact our office on (07) 5556 3300 or info@wmssolutions.com.au

DISCLAIMER: This article is intended to provide a general summary only and should not be relied on as a substitute for professional advice.

© 2020 WMS Solutions Pty Ltd

Check out other interesting articles: