Last week the Federal Labor Government announced changes to the legislated Stage 3 individual income tax cuts.

The tax cuts for the top income brackets will be approximately halved, with the difference being redistributed to the low and mid range income brackets. These proposed changes will now need to pass through Parliament before the will come into effect. The Government has stated that they are optimistic that the changes will be passed prior to their intended commencement date of 1 July 2024.

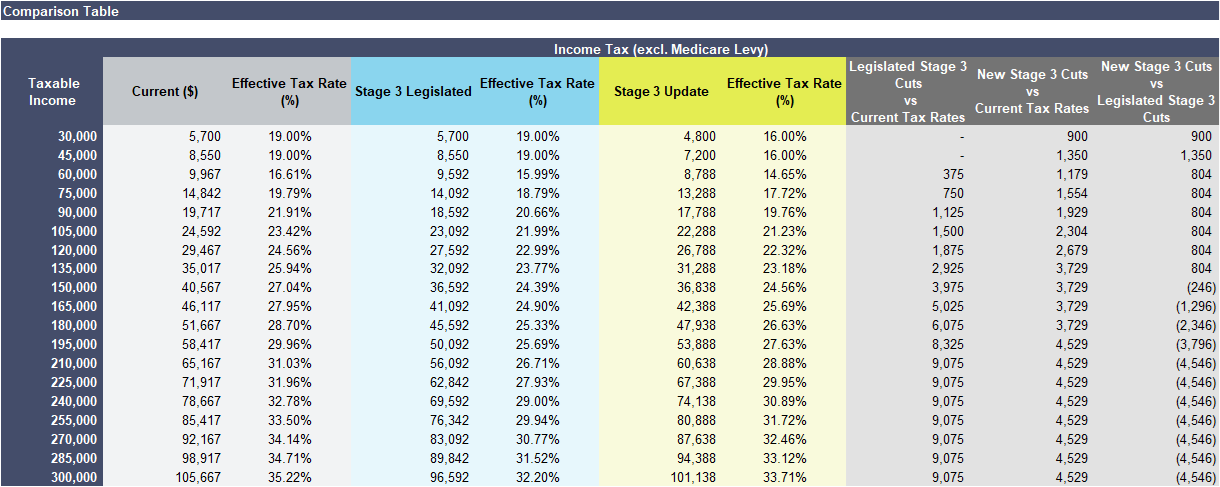

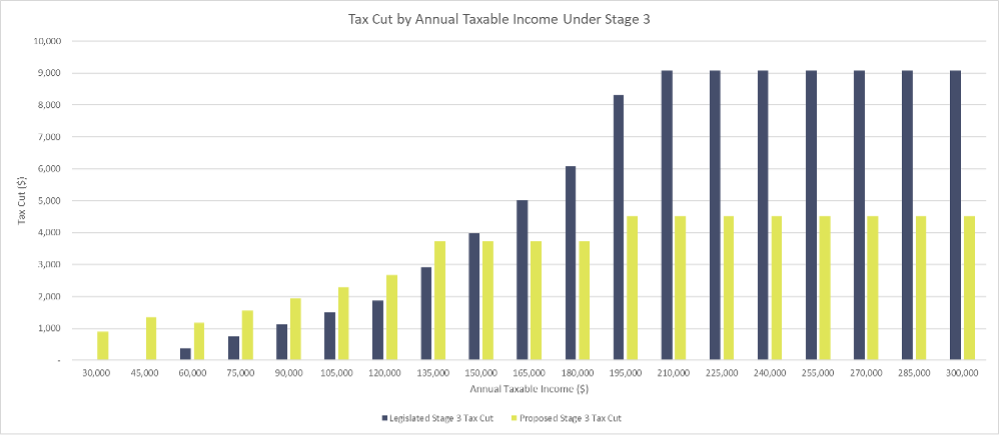

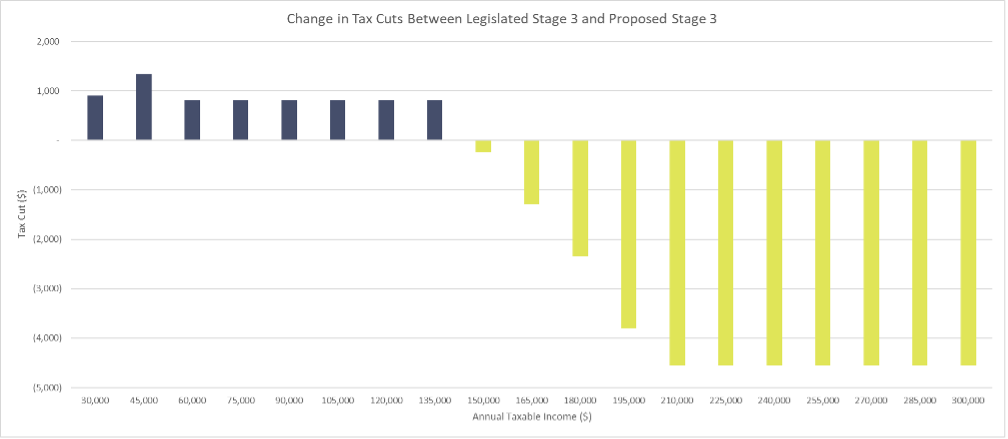

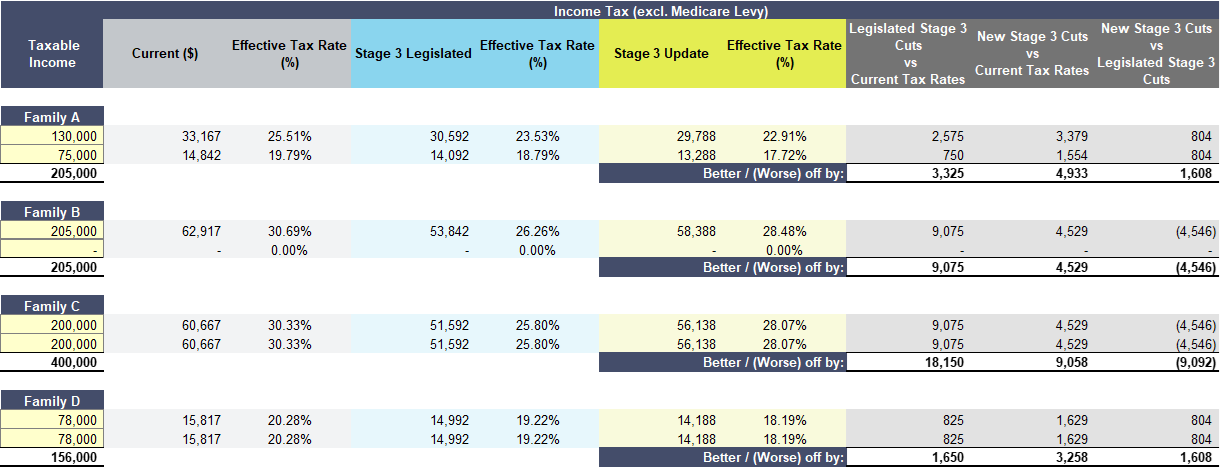

Individuals with taxable income between $18,200 and $135,000 will receive a larger tax cut than what has already been legislated for Stage 3, whereas income earners with taxable income greater than $135,000 will receive a smaller tax cut than what has already been legislated. All individual tax payers will still receive a tax cut, but the quantum of the cut will be different to what has been legislated.

Individuals earning $200,000 or more will have their tax cuts reduced by $4,418 from $9,075 to $4,675, while the median Australian employee earning $78,000 per year (per ABS August 2023 statistics) will have their share of tax cuts increase by $932 from $825 to $1,757.

The Government’s Press Release today detailed the following as a result of these change, on 1 July 2024:

- All 13.6 million taxpayers will receive a tax cut – and 2.9 million more taxpayers will receive a tax cut compared to the Legislated plan.

- 11.5 million taxpayers (84 per cent of taxpayers) will now receive a bigger tax cut compared to the Legislated plan.

- 5.8 million women (90 per cent of women taxpayers) will now receive a bigger tax cut compared to the Legislated plan.

- A person on an average income of around $73,000 will get a tax cut of $1,504 – that’s $804 more than they were going to receive under the Legislated plan.

- A person earning $40,000 will get a tax cut of $654 – compared to nothing under the Legislated plan.

- A person earning $100,000 will get a tax cut of $2,179 – $804 more than they would receive under the Legislated plan.

- A person earning $200,000 will still get a tax cut, which will be $4,529.

The new resident individual income tax rates and thresholds for 2024-25 will be:

| Current 2023-24 rates | Legislated Stage 3 Cuts | Proposed Stage 3 Cuts | |||

| Income Bracket ($) | Marginal Tax Rate | Income Bracket | Marginal Tax Rate | Income Bracket | Marginal Tax Rate |

| <18,200 | 0% | <18,200 | 0% | <18,200 | 0% |

| 18,201 – 45,000 | 19% | 18,201 – 45,000 | 19% | 18,201 – 45,000 | 16% |

| 45,001 – 120,000 | 32.5% | 45,001 – 200,000 | 30% | 45,001 – 135,000 | 30% |

| 120,001 – 180,000 | 37% | 135,001 – 190,000 | 37% | ||

| >180,000 | 45% | >200,000 | 45% | >190,000 | 45% |

The impact of the proposed changes is shown in the below table: