From November 2021, all company directors will require a Director Identification Number (DIN).

Your director ID will confirm your identity and trace your relationships to companies. Directors

must apply for their director ID themselves because they need to verify their identity.

No one can apply on their behalf.

What is a DIN?

A director identification number (director ID or DIN) is a unique identifier you need to apply for

once and will keep forever. It will help prevent the use of false or fraudulent director identities.

DIN’s will be confidential and should be treated the same as a Tax File Number.

Who needs one?

You need a director ID if you’re an eligible officer of:

• a company, a registered Australian body or a registered foreign company under the

Corporations Act 2001 (Corporations Act).

• an Aboriginal and Torres Strait Islander corporation registered under the Corporations

(Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

An eligible officer is a person who is appointed as:

• a director

• an alternate director who is acting in that capacity.

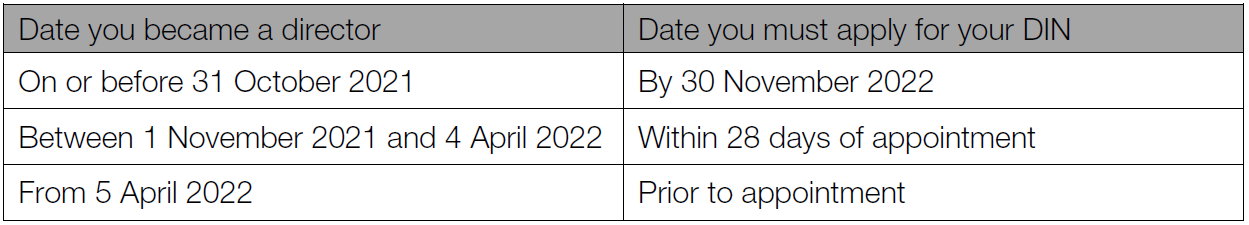

Relevant Dates

Application Process

Step 1 – Set up myGovID

can found here. Please be aware that a myGovID is separate to myGov.

Step 2 – Gather your documents

When applying for your DIN, you will need to provide the following:

• Your tax file number (TFN);

• Residential address as held by the ATO; and

• Information from two documents to verify your identity.

Examples of documents you can use are:

• Bank account details;

• Income Tax Notice of Assessment (NOA);

• Superannuation account details;

• A dividend statement;

• Centrelink payment summary;

• PAYG payment summary.

Step 3 – Complete your application

Once you have completed your myGovID set up, you can log in here and apply for your DIN on the ABRS website. You can apply for your DIN from November 2021.

Meeting your obligations

Your director ID obligations include:

• applying for a director ID within the relevant timeframe for your situation

• applying for a director ID when directed by the Registrar to do so

• not applying for more than one director ID (unless directed by the Registrar to do so)

• not misrepresenting your director ID to a Commonwealth body, company, registered Australian body or Aboriginal and Torres Strait Islander corporation

• not being involved in a breach of the above director ID obligations.

If you don’t meet your obligations:

• there may be civil or criminal penalties

• you may be issued with an infringement notice.

Please contact your WMS advisor if you require further assistance or information.

Updated: 1 November 2021

Check out other interesting articles: