We believe the government has produced a budget which has met its core objective to stimulate spending and avoid material drops in employment rates post the COVID-19 based measures such as Job Keeper. We have provided a comprehensive summary of the key tax and superannuation based initiatives and encourage clients and friends of the firm to touch base with us to take advantage of the many planning opportunities.

For a PDF summary of these key points, please click here.

Individuals

Tax Cuts

The second stage of tax cuts for low to middle income earners have been bought forward from the legislated date of 1 July 2022 and will be back dated to 1 July 2020.

These tax cuts lift the top threshold of the;

– 19.0% tax bracket from $37,000 to $45,000

– 32.5% tax bracket from $90,000 to $120,000.

The low-income tax offset has been increased to a maximum of $700.

The low to middle income tax offset, maximum of $1,080, has been retained for the 2020-21 financial year.

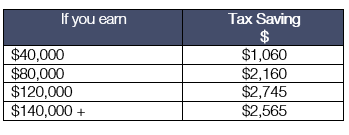

The table below details the tax savings an individual can expect to receive:

Payments for Income Support Recipients

Two separate additional cash payments of $250 will be received by eligible income support recipients, such as those in receipt of the Age Pension, and concession card holders. With the first payment expected to be received at Christmas this year and the second payment in March next year. This is in addition to the payments already received.

Businesses

Instant asset write-off

The instant asset write-off scheme introduced during the COVID19 pandemic will be extended.

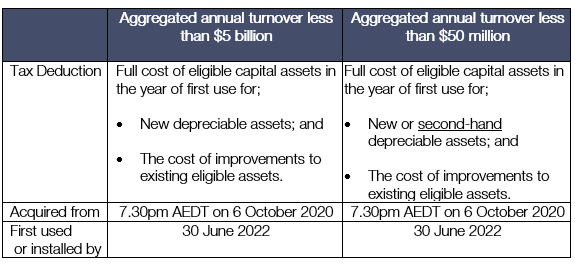

From 7.30pm (AEDT) on 6 October 2020, Business with a turnover up to $5 billion will be able to write off the full cost of eligible depreciable assets of any value purchased (in the year they are installed) for the next 2 years to 30 June 2022.

Summarised as per the table below;

Loss Carry-Back

Companies with a turnover up to $5 billion will also be able to carry back (offset) losses made in the 2019-20, 2020-21 or 2021-22 financial years to offset profits in the 2018-19 financial year or later financial years, on which tax has been paid.

As a result, eligible Companies may elect to receive a refund on tax they have already paid when they lodge their 2020-21 and 2021-22 financial year tax returns.

Additional R&D Incentives

The Government announced that it will defer the start of the previously announced changes to the R&D tax incentive to income years starting on or after 1 July 2021 with the following now proposed;

– For those with a turnover of less than $20 million, the refundable R&D tax offset will increase and there will be no cap on annual cash refunds,

– For those with a turnover of more than $20 million the intensity test will be streamlined and the non-refundable R&D tax offset will be increased.

The previously announced increase to the R&D expenditure threshold from $100 million to $150 million per annum will go ahead unchanged.

Expanded Small Business Tax Concessions

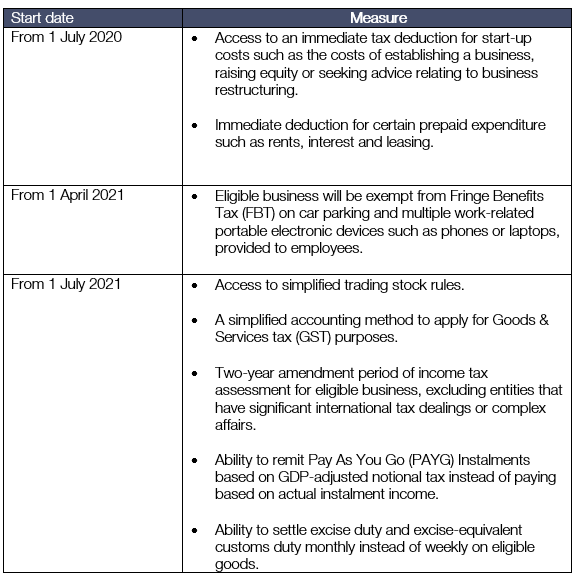

‘The Government announced it will allow business with less than $50 million aggregated annual turnover, up from $10 million, to access the small business concessions.

The concessions which apply in three phases, are summarised below;

Job Maker Program

Employers will be able to claim a credit of up to $200 when they hire staff aged between 16 to 35 who were in receipt of government support such as Job Seeker, youth allowance or parenting payments for at least one of the three months prior to being hired.

Employees will have to work for at least 20 hours a week for the employer.

To be eligible, employers will need to demonstrate an increase in overall employee headcount and payroll for each additional new position created.

Superannuation Reforms

From 1 July 2021, the Government will implement the following reforms to improve outcomes for superannuation account holders;

• Existing superannuation account will ‘stapled’ to a member so they keep their superannuation account when they change employment;

• New Online YourSuper tool to compare and select superannuation products;

• My Super products will be subject to an annual performance test. Funds that underperform for two consecutive years will not be permitted to accept new members until their performance improves; and

• Strengthening the obligations of superannuation trustees to ensure their actions are consistent with members’ retirement savings being maximised.

Superannuation Guarantee (SG)

The budget did not announce any change to the timing of the next SG rate increase.

The SG rate is currently legislated to increase from 9.5% to 10% from 1 July 2021, and by 0.5% per year from 1 July 2022 until it reaches 12% from 1 July 2025.

Should you have any questions, please do not hesitate to contact our office on (07) 5556 3300 or info@wmssolutions.com.au

DISCLAIMER: This article is intended to provide a general summary only and should not be relied on as a substitute for professional advice.

© 2020 WMS Solutions Pty Ltd

Check out other interesting articles: