Taking your employer superannuation obligations seriously.

The ATO announced last week that they are undertaking a targeted letter campaign against employers who have not met their SG obligations. This involves sending letters to around 2,500 employers and their tax agents.

With the introduction of Single Touch Payroll (STP) and aided by more sophisticated data matching capabilities, the ATO is in a better position than ever before to actively monitor compliance.

As an employer, your obligations in respect of your employees’ superannuation are significant and the penalty regime for non-compliance is strict and substantial.

With the September quarter deadline just under a week away, it is imperative that you understand these responsibilities.

Pay by the due date or pay the penalty

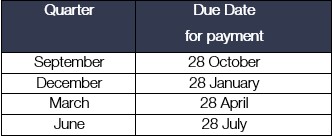

The simple directive in relation to (SG) contributions is to pay the correct amount by the due date or pay the penalty. SG contributions must be paid for each eligible employee to the correct super fund at least four times a year by the following cut-off dates:

The general rule is that SG contributions must be paid at a rate of 9.5% of ordinary times earnings for most employees earning over $450 per month and certain contractors. Relevant contractors are those who are employed under a contract that is wholly or principally for their labour and only applies where you contract with an individual (ie you are not required to pay superannuation where you contract with an entity such as a company, trust or partnership, assuming the contractual arrangement would not be considered a sham).

Employers who do not pay the correct amount by the relevant deadline are liable to pay an SG charge to the ATO.

SG payments that are made even just a few days late will still attract this penalty.

The SG Charge is 9.5% on all wages, not just ordinary earnings (and this is regardless of whether you have since made a payment or not), plus nominal interest at 10% p.a. calculated from the beginning of the quarter up until such time as the employer lodges the required SGC statement. An administrative charge of $20 per employee is also imposed.

If you are late paying your SG obligations, you must self-assess your SG charge liability, and remit the payment and an SGC statement to the ATO by the 28th day of the second month following the end of the quarter.

Why should I lodge an SGC statement if I have already paid the late super?

If a SGC statement is never lodged by an employer, the nominal interest penalty will continue to accrue on an ongoing basis, even after the late payment is made to the employee’s super fund, up until such time as an SGC statement is lodged, or the ATO issues a default assessment.

Directors are personally liable

Importantly, company directors have a legal responsibility to ensure that their company meets its SG charge obligations. The director of a company that fails to meet an SG liability in full by the due date becomes personally liable for a penalty equal to the unpaid amount.

Pay late and you will also lose your tax deduction

In addition, if you do not pay your superannuation by the relevant quarterly deadline then the expense is no longer tax deductible. The SG charge and any associated interest and penalties are also not deductible.

The law is undoubtedly strict and the penalties for failure to comply can be significant if you do not meet your payment and reporting obligations.

SG AMNESTY BACK ON THE TABLE

The Government has reintroduced the controversial SG amnesty legislation into Parliament which lapsed at the calling of the last election. The legislation provides for a once off amnesty to encourage employers to self correct historical SG non compliance without penalty.

The amnesty covers the period between 1 July 1992 and 31 March 2018 and will allow employers to claim tax deductions for payments of SG charge or for contributions made during the amnesty period to offset SG charge. It will also remove the administrative component and the Part 7 penalty that may otherwise apply in relation to past SG non compliance. The interest component will still apply.

The legislation also includes measures which limit the ATO’s ability to reduce penalties for those employers who fail to avail themselves of the amnesty and are subsequently found to not comply. In these cases, the minimum penalty which will apply is 100%, a very severe outcome for the employer.

If you require clarification in respect of the above, or if you are concerned about your obligations under the legislation and would like to discuss the matter further, please do not hesitate to contact our office. Should the bill be passed, the amnesty period will end 6 months from the date the bill receives royal assent.

DISCLAIMER: This article is intended to provide a general summary only and should not be relied on as a substitute for professional advice.

© 2019 WMS Solutions Pty Ltd

Check out other interesting articles: